The surge in mutual fund investments is indeed impacting bank deposit growth in India, with the credit-deposit ratio reaching a 20-year high of 80% in March 2024. However, the relationship is more complex than simple competition—banks also benefit from the mutual fund boom through custodian fees, distribution commissions, and evolving customer relationships.

The Numbers Tell a Compelling Story

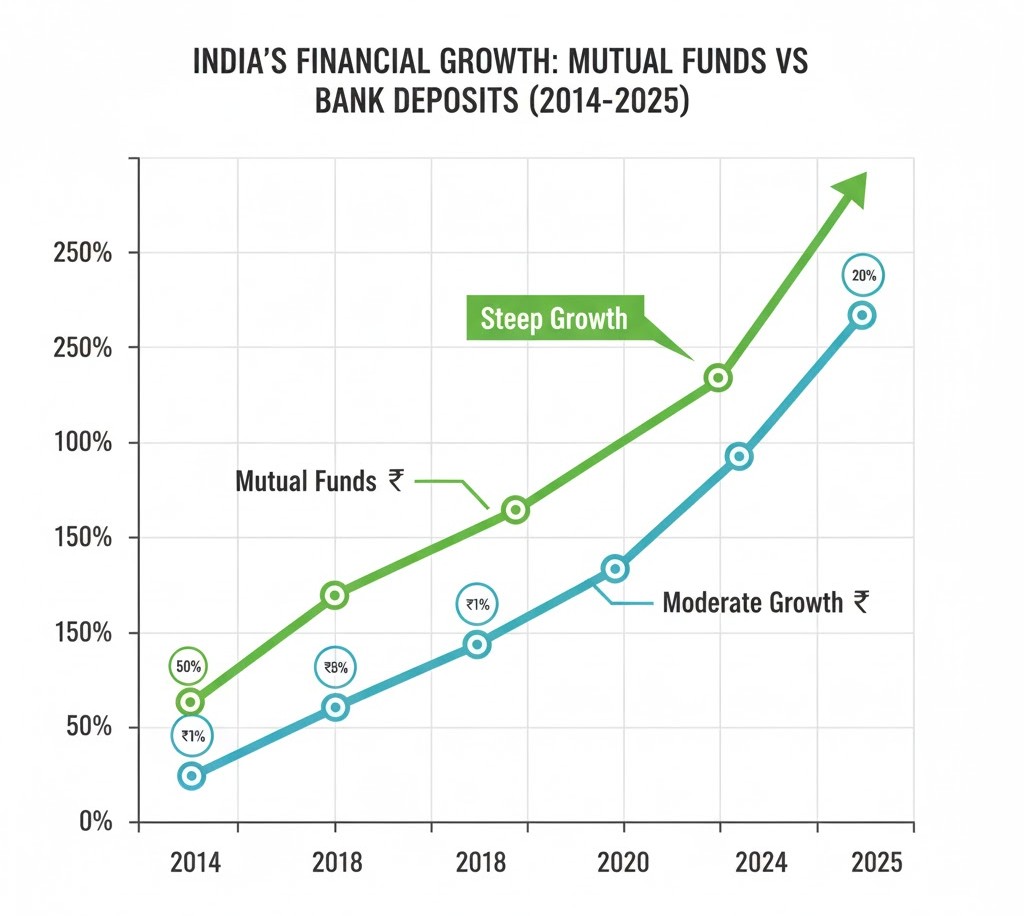

Picture this: In 2014, mutual fund assets were just 10% of bank deposits in India. Fast forward to 2025, and that number has jumped to 31.2%—more than tripling in just over a decade.

Meanwhile, as of June 2024, bank deposits grew at a modest 11.1% year-on-year, while credit growth surged ahead at 17.4%. This widening gap has set off alarm bells at the Reserve Bank of India (RBI) and sparked urgent meetings between the Finance Ministry and bank chiefs.

But is this a crisis or an evolution? Let’s dig deeper.

What’s Actually Happening: The Data Breakdown

The Mutual Fund Explosion

The Indian mutual fund industry’s assets under management crossed Rs 68 lakh crore in November 2024, marking a remarkable 34% increase from Rs 50.78 lakh crore in December 2023. This sixfold increase from a decade ago represents one of the fastest-growing asset management sectors globally.

The real game-changer? Systematic Investment Plans (SIPs).

SIP inflows climbed from Rs 17,610 crore in December 2023 to Rs 25,320 crore in November 2024, with total SIP inflows reaching Rs 2.4 trillion for the January-November 2024 period. That’s not just growth—that’s a fundamental shift in how Indians save and invest.

The Banking Sector’s Headache

The credit-deposit ratio reached 80% in March 2024, its highest level since 2005, as bank credit grew at 19% while deposits grew by only 13.6% in FY 2024.

Translation? Banks are lending out more money than they’re receiving in deposits—a situation that’s mathematically unsustainable in the long run.

Since the pandemic, lending in India has seen strong growth at approximately 15% CAGR, while deposits have lagged at around 11% CAGR. Even more concerning, the composition of deposits is changing.

CASA (Current Account Savings Account) contribution decreased from 43% to 39% in fiscal year 2024, meaning banks are losing their cheapest source of funds.

Why Are Indians Choosing Mutual Funds Over Bank Deposits?

1. The Returns Game

Let’s be honest—when fixed deposits offer 6.5-7% returns while equity mutual funds have delivered 15-24% over recent years, the choice becomes obvious for many investors.

Equity funds controlled 58.97% of the India mutual fund market in 2024, with bond funds attracting conservative capital through 6.8-7% yields that brought a 24% AUM lift in 2024.

Even conservative debt mutual funds have been matching or beating traditional FD returns, without the hassle of TDS and with better tax efficiency on long-term gains.

2. The Digital Revolution

Remember when investing in mutual funds meant filling out lengthy forms at a bank branch? Those days are gone.

The number of demat accounts with NSDL and CDSL increased to 15.14 crore in FY24 compared to 11.45 crore the previous year. Apps like Zerodha, Groww, and Paytm Money have made investing as easy as ordering food online.

Compare this to bank deposits, where you still need to visit branches for many transactions, deal with premature withdrawal penalties, and face rigid terms.

3. Inflation Anxiety

Investors no longer find it lucrative to park their funds in traditional savings accounts, as alternative assets like stocks and mutual funds have generated higher returns than term deposits, which have managed only to beat inflation by approximately 1-2%.

When inflation runs at 5-6%, earning 7% on a fixed deposit means your real return is barely 1-2%. For younger investors especially, this feels like running on a treadmill—lots of effort, minimal progress.

4. The Aspiration Economy

Millennials and Gen-Z investors overwhelmingly favor automated SIPs, supplying long-duration cash that helps fund managers ride volatility, with monthly SIP inflows climbing to Rs 26,632 crore in April 2025—an all-time high.

This generation has watched property values and stock markets multiply. They’ve seen their parents’ generation prosper through equity exposure. The psychological shift from “safety first” to “growth first” is real and accelerating.

The RBI’s Wake-Up Call

RBI Governor Shaktikanta Das hasn’t minced words about this issue. He’s repeatedly cautioned banks about the structural liquidity challenges arising from the deposit-credit mismatch.

As of June 28, 2024, deposits grew by 11.1% year-on-year while credit growth surged by 17.4%, with Das highlighting concerns that households increasingly divert their savings to mutual funds and other financial instruments, potentially leading to structural liquidity issues.

The central bank has taken action too. The RBI recently launched draft guidelines increasing banks’ liquidity requirements, with a higher run-off factor of 10% from 5% previously for stable deposits received through mobile and internet banking, and 15% for less stable deposits.

Translation: Banks will need to hold more government securities as a buffer, which will moderate their lending appetite and force them to compete harder for deposits.

The Other Side of the Story: It’s Not All Bad News for Banks

Here’s where the narrative gets interesting. Banks aren’t just passive victims of the mutual fund boom—they’re actually profiting from it in several ways.

1. Custodian Fees: The Hidden Revenue Stream

Banks earn custodian fees for holding mutual fund assets on behalf of investors, and data show a correlation coefficient of 0.98 between bank deposits and mutual fund AUM, indicating that an increase in bank deposits leads to an increase in industry AUM and vice versa.

Every mutual fund in India must appoint a custodian—typically a bank—to hold its securities. These custodians charge fees for safekeeping, transaction settlement, and administrative services. With mutual fund AUM crossing Rs 68 lakh crore, these custodian fees represent a significant revenue stream.

2. Distribution Commissions

Banks are large distributors of mutual funds, selling approximately Rs 1.9 lakh crore worth of mutual funds to individuals in FY24.

Banks earn distribution commissions ranging from 0.5% to 1.5% on mutual fund sales through their regular plans. While they lose a deposit customer, they gain a distribution fee—and often retain the customer relationship.

3. Transaction Banking Services

When investors buy or redeem mutual funds, the money flows through bank accounts. The increased transaction activity generates:

- Account maintenance fees

- Transaction charges

- Payment gateway fees

- Cross-selling opportunities

When retail investors move funds from savings accounts into investments, deposits often shift into current accounts, and vice versa when investments are redeemed.

4. Evolving Revenue Models

Forward-thinking banks are pivoting from being just deposit-takers to becoming financial solution providers. They’re:

- Building wealth management platforms

- Offering robo-advisory services

- Creating hybrid products that combine deposits with mutual funds

- Developing fee-based income streams

The Symbiotic Relationship Nobody Talks About

Here’s a fascinating insight: The interaction and transaction load for banks, along with earnings in the form of custodian fees for holding funds on behalf of investors, are likely to shape the future of both industries.

Think of it this way—mutual funds need banks for:

- Custodial services

- Payment processing

- Distribution networks

- Regulatory compliance

Banks need mutual funds for:

- Fee-based income diversification

- Customer engagement

- Competitive product offerings

- Retention of younger customers

This isn’t a zero-sum game where one industry wins and the other loses. It’s an interdependent ecosystem that’s evolving.

What Banks Are Doing to Fight Back

Indian banks haven’t been sitting idle. They’ve launched several initiatives:

1. Special Deposit Schemes

All state-owned banks, which hold approximately 60% of total system deposits, have launched special deposit schemes to attract deposits and are offering higher interest rates of 7.15-7.30% for tenures less than two years.

2. Branch Expansion

Despite increased adoption of digital accounts, banks are also resorting to the tried and tested method of adding physical branches to partially resolve the deposit-mobilization issue.

3. Government Intervention

Finance Minister Nirmala Sitharaman has urged public sector banks to run special campaigns to promote deposit growth in response to the relatively low deposit growth rate.

4. Digital Innovation

Banks are investing heavily in:

- Mobile-first banking experiences

- Instant fixed deposits with flexible terms

- Gamified savings challenges

- Goal-based deposit products

The Global Context: India Is Still Catching Up

Before we panic about deposits fleeing to mutual funds, consider this perspective:

At the end of FY25, the Indian mutual fund industry stood at 28% of bank deposits in India—the highest share so far, up from 16% at the end of FY20. However, in developed economies this share is actually more than 100% of bank deposits; in April 2025, the AUM of the mutual fund industry stood at 118% of bank deposits in the US.

In other words, India’s “crisis” is actually just the beginning of financial market maturation. We have enormous headroom for growth.

Unique investor counts crossed 54.6 million by April 2025, yet penetration is only 3.6% of the population, suggesting vast headroom for inclusion.

The Bigger Picture: A Maturing Financial Ecosystem

What’s happening in India isn’t a banking crisis—it’s a financial system evolution. Here’s why this shift is ultimately positive:

1. Better Capital Allocation

When money flows to mutual funds, it gets invested in equities and corporate bonds. This provides crucial growth capital to businesses, creating jobs and economic expansion.

Bank deposits, while safe, often get invested in government securities or lent to a limited set of borrowers. Mutual funds democratize investment across thousands of companies.

2. Risk Diversification for Households

Putting all savings in bank deposits exposes households to interest rate risk and inflation erosion. A diversified portfolio across bank deposits, mutual funds, and other assets creates better financial security.

3. Financial Market Deepening

A report by the National Stock Exchange projects that by 2033, the share of cash and deposits will fall to 41%, while mutual funds and equity are expected to account for 24% of total financial assets, indicating a notable shift towards capital markets.

Deeper, more liquid capital markets attract foreign investment, lower borrowing costs for companies, and strengthen the entire financial system.

4. Improved Financial Literacy

The mutual fund boom is forcing millions of Indians to understand concepts like:

- Risk and return

- Asset allocation

- Market cycles

- Long-term investing

This financial education benefits the entire ecosystem, including banks.

The Challenges That Remain

Let’s not sugarcoat the difficulties:

1. Liquidity Management

When credit growth significantly outpaces deposit growth, banks may struggle to meet their liquidity requirements such as the Cash Reserve Ratio, Statutory Liquidity Ratio, and Liquidity Coverage Ratio.

If deposit growth continues lagging, banks may be forced to:

- Slow down lending (hurting economic growth)

- Increase interest rates on deposits (squeezing margins)

- Rely more on expensive market borrowings

2. Margin Pressure

As growth in deposits trails credit expansion, lenders will likely compete for deposits, driving up their funding costs, with systemwide net interest margins expected to slip to 2.9% in FY25 from 3% in FY24.

Banks make money on the spread between deposit rates and lending rates. Higher deposit rates mean lower profitability.

3. Behavioral Risks

New-age mobile applications and tech-enabled banking have made it easier for customers to instantly transfer or withdraw funds from their accounts, questioning customer stickiness in the banking environment.

The old model where customers kept money in savings accounts out of habit is gone. Today’s customers are hyper-aware and mobile-enabled.

4. Market Volatility Concerns

When mutual funds delivered stellar returns in 2023-24, the shift accelerated. But what happens during a market crash?

If equity markets fall 30%, will disappointed investors rush back to bank deposits? Or have they internalized the long-term investing mindset? Time will tell.

What This Means for Different Stakeholders

For Individual Investors

Don’t follow the herd blindly. Your decision should be based on:

- Time horizon: Need money within 3 years? Bank deposits are still safer

- Risk appetite: Can you stomach a 20% portfolio drop without panic?

- Financial goals: Emergency fund should always be in liquid, safe deposits

- Tax situation: Different instruments have different tax treatments

The ideal approach? A balanced portfolio with both bank deposits (for stability and emergencies) and mutual funds (for growth and wealth creation).

For Banks

The writing is on the wall—adapt or become irrelevant. Winning strategies include:

- Transform from product-sellers to financial advisors

- Develop compelling digital experiences

- Create innovative deposit products with flexibility

- Leverage data analytics for personalized offerings

- Build comprehensive wealth management platforms

Banks are poised in a strategic place to offer advice to investors to manage their portfolios, and the branch network allows for the use of technology-aided advisory services that keep customers from wandering off elsewhere.

For Regulators

The RBI and SEBI need to:

- Monitor systemic risks from rapid financialization

- Ensure retail investors understand mutual fund risks

- Prevent misselling and ensure suitability

- Balance growth with stability

- Coordinate policies across banking and capital markets

For the Economy

According to the latest RBI data, deposits in banks grew 11.74% year-on-year during the fortnight ended October 18 to Rs 218.07 trillion, while credit growth came in at 11.52%, suggesting the alignment of deposit growth with credit expansion.

Recent data shows the gap is narrowing—partly due to RBI’s regulatory measures and partly due to banks getting aggressive on deposits. This is healthy stabilization.

The 2025 Outlook: What Experts Predict

The Indian mutual fund industry is on track for sustained growth in 2025, expected to benefit from India’s strong economic fundamentals, government-backed initiatives, and rising investor interest.

Most analysts predict:

- Mutual fund AUM: Expected to reach Rs 100 trillion by 2030

- Deposit growth: Likely to stabilize around 11-12% annually

- Credit growth: Moderating to 12-13% to align with deposits

- CD Ratio: Gradually declining from current highs

The “crisis” narrative may be overblown. What we’re witnessing is recalibration, not collapse.

The Verdict: Competition or Coexistence?

So, are mutual funds a threat to banks? Yes and no.

Yes, they’re a competitive threat in the traditional deposit-gathering business. The days of customers automatically parking all savings in fixed deposits are over.

No, they’re not an existential crisis. Banks remain essential to the financial system and are finding new revenue streams. The symbiotic relationship between banks and mutual funds is strengthening, not weakening.

The real story isn’t about mutual funds stealing deposits from banks. It’s about:

- Financial markets maturing

- Household savings becoming more sophisticated

- The banking business model evolving

- Capital being allocated more efficiently

Key Takeaways

- The shift is real: Mutual fund AUM has grown from 10% to 31% of bank deposits in a decade

- Banks feel the squeeze: Credit-deposit ratios at 20-year highs are creating liquidity concerns

- It’s not just competition: Banks earn custodian fees, distribution income, and transaction revenues from mutual funds

- Global context matters: India is still far behind developed markets in mutual fund penetration

- Balance is returning: Recent data shows deposit and credit growth converging

- Evolution, not crisis: This represents financial market deepening, not banking sector collapse

- Diversification wins: Households benefit from having both deposits and mutual fund investments

What Should You Do?

Whether you’re an investor, banker, or just financially curious:

For your money: Maintain 6-12 months of expenses in bank deposits for emergencies. Invest surplus for long-term goals in a diversified mix of mutual funds based on your risk profile.

For your perspective: Stop thinking “deposits versus mutual funds” and start thinking “deposits AND mutual funds.” Both have roles in a healthy financial ecosystem.

For your future: Stay informed, stay diversified, and understand that financial markets evolve. What worked for your parents’ generation may not be optimal for yours.

The Indian financial system is growing up. There will be growing pains, adjustments, and regulatory fine-tuning. But ultimately, a financial system where households have choices, capital flows efficiently, and both banks and mutual funds thrive together is better for everyone.

The question isn’t whether mutual funds are harming banks. The question is: Are we building a more resilient, inclusive, and efficient financial system? Based on the evidence, the answer seems to be yes.

Leave a comment